Bitcoin Whales Accumulate as Dip Targets $94K Zone

Despite Bitcoin’s sideways trading, major players continue building long positions. But analysts still warn of a possible correction toward $94,000.

Big Buyers Stack BTC as Market Consolidates

Bitcoin is holding near the $105,000 level after peaking at $112,000, but price action remains choppy within a narrow $5,000 range. According to Keith Alan, co-founder of Material Indicators, the market is showing strength as large traders continue to increase their exposure.

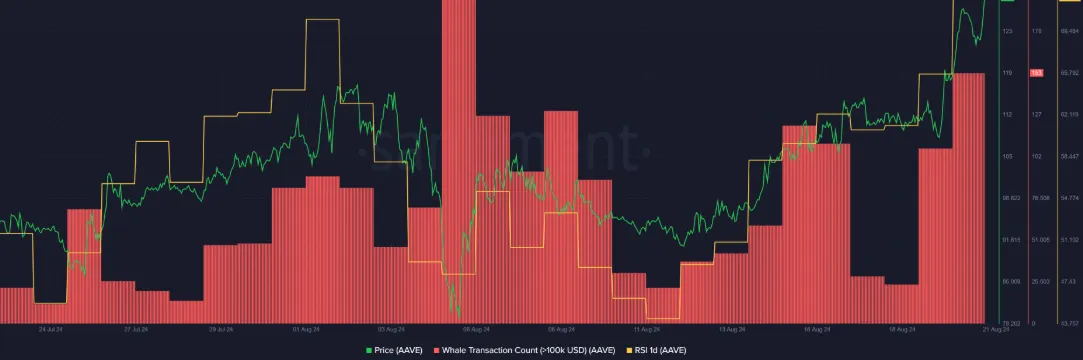

“Whales are buying while BTC consolidates above $100K,” Alan posted on X, pointing to an uptick in transaction volume from major accounts.

His chart also highlighted that $112,000 currently attracts the largest cluster of ask liquidity, showing intense activity from sellers at those levels.

$94K Identified as Potential Bounce Zone

If bearish momentum builds, Alan suggested a downside level to watch: the 21-week moving average, currently near $94,000.

“We’re clearly in a bull trend, but no rally is linear. Seven or more weekly green candles in a row usually signals a pause,” Alan wrote.

He emphasized that even within strong trends, corrections are healthy and normal. A pullback to $94,000 would still align with the broader bullish structure.

BTC May Retrace Recent Gains

Cointelegraph previously reported on the possibility of a deeper correction, potentially undoing gains made since the April breakout. While bullish momentum dominates the long-term view, traders are watching for signs of a short-term reversal.

Whales Fuel Liquidity Games

James Wynn, a high-profile trader on Hyperliquid, has become a lightning rod for attention with his leveraged plays. Wynn frequently shares his BTC positions on social media, and some claim market participants are now targeting his liquidation levels.

“They FORCED BTC to $108.7K — my exact liquidation price,” Wynn posted on X, claiming he narrowly escaped getting liquidated by acting quickly.

HyperDash data showed Wynn running a 40x long position, which was $3.4 million in the red as of May 28. His aggressive strategy has become a market signal for some and a cautionary tale for others.